- How to negotiate

- Posts

- Episode 40: How to negotiate startup equity

Episode 40: How to negotiate startup equity

I saw the equity as a loss because I didn’t understand how to quantify the value of what I was getting. One company had an equity simulator, but it was based on a 20x outcome for the company. I had no idea to gauge whether that was realistic.

👋 Yo! Welcome to the next episode of How to Negotiate, where you learn how to grow your career and income with better negotiation strategy in less than 5 minutes.

Last week, I was catching up with a friend about all things startup equity. He was negotiating a job offer and wanted to understand how to think about the value of the equity that comes with startups.

Early in my career, my default position was to ask for the $ equivalent of the equity as a one-time bonus. I saw the equity as a loss, so didn’t bother negotiating it at all. This never worked and in fact sent the wrong message to the hiring team.

Equity = ownership in the company. You declining the equity sends a message that a) you don’t believe the company will be worth something in the future b) you won’t be around long enough to realize that value. Either way, not a great signal as a hiring team.

Personally, I saw the equity as a loss because I didn’t understand how to quantify the value of what I was getting. One company had an equity simulator, but it was based on a 20x outcome for the company. I had no idea to gauge whether that was realistic.

Here’s what to do instead:

Get additional information

Here are the questions I ask every hiring team when evaluating an offer:

What was the most recent 409a valuation?

How many shares outstanding as of last 409a valuation?

What is the most recent strike price?

Let’s break them each down:

409a: Every private company undergoes a valuation process (409a) by a 3rd party based on the size/stage/progress of the company. This valuation amount is calculated yearly, so it’s a look into the company's value for that year.

Shares: Typically in the offer letter you are given a # of shares, but you need to contextualize this. 1,000 shares when there are a 1,000,000 total shares (1%) is a big difference than 1,000 shares when there are 10,000,000 (0.1%).

Strike price: Private companies typically issue stock options — i.e. the option to purchase. The cost to purchase these stocks is the strike price. As an employee you get a preferred rate relative to when the company goes public (you get a deal for going in early).

It’s normal for the recruiter to get back to you / ask someone else for these things. Remember, most people treat equity as funny money, so they don’t know what you should ask. Also, you aren’t asking for anything proprietary, so the company should have no issue sharing but be open to signing an NDA if necessary.

Value your equity

Now you have all the inputs to do some math and research to define the value of the equity for you.

I say for you, because the main unknown is how well the company will actually do. You can use another company in the space as a proxy, but ultimately it’s your conviction on how the company will do.

Also going public isn’t the only option - getting acquired by a competitor, partner, or PE firm are also viable options. Sometimes, companies are shooting for one outcome, but at the early stage, all options are on the table.

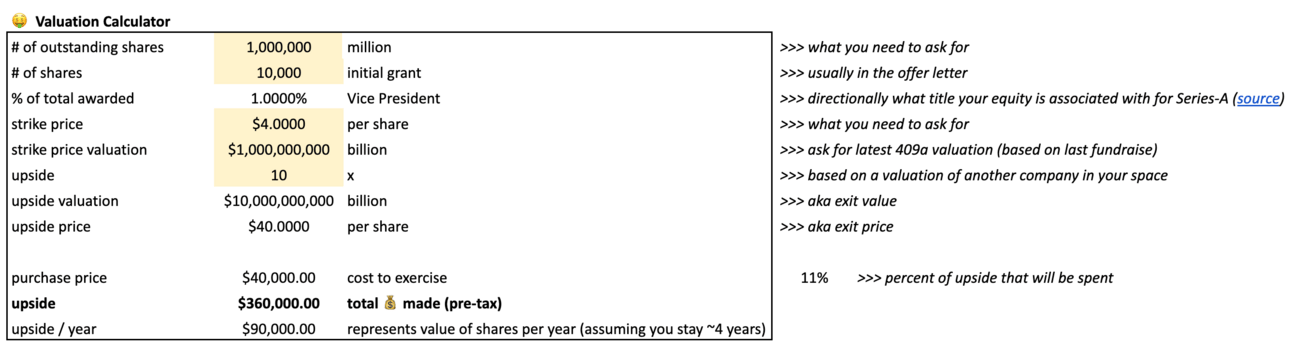

Here’s a calculator template you can use to evaluate equity:

The hardest cell to fill out will be the ‘upside’ - i.e. how well the company will do if they go public. It’s usually in the form of a multiple. Example: company valued at $2B has a 10x outcome which means it’s now worth $20B.

Your best bet is to find a similar company in the industry and see the valuation at last public raise and then calculate the multiple for when they went public.

Example walkthrough: If you are offered 10,000 shares for $4.00 per share, it will cost you ~$40,000 to purchase those shares ($4.00 × 10,000). If you believe the company will have a 10x outcome, those shares are worth 10x minus what you must pay to purchase them —> ~$360,000 ($40,000 X 10 - $40,000).

Divide that number by 4 (how long it typically takes for the company to give you the shares, aka vest), and that’s the value of the equity per year that you can add to your salary each year to evaluate an offer vs. your current job / another offer.

Said differently, for every $1B the company is valued, you make an additional $10,000 per year. Depending on how early you joined, you can easily negotiate an extra 0 to your earnings.

Negotiate your equity

Once you understand the value of your equity, you can begin negotiating it just like you would your salary, benefits or other aspects of your offer.

Remember you can’t negotiate everything, but everything is negotiable. While asking for the value of the equity in the form of salary sends a negative signal to the hiring team, asking for 2-3x the amount of equity sends a highly positive signal.

The worst situation is that they counter with something lower, but remember that equity is ownership in a company. You are joining a company (depending on stage) early to get a bigger (and cheaper) stake, so asking for a bigger stake is always an option.

If you are unsure about the equity, start by negotiating the salary and then negotiate the equity once you feel comfortable with the salary numbers. You are doing yourself a disservice by ignoring the equity altogether, but if you choose to do so, don’t let it be because of a lack of knowledge.

If you ever need help evaluating your equity, researching a company in a similar industry to get a realistic multiple, or negotiating your equity, feel free to reach out!

As always, feedback is a gift and I welcome any/all feedback on this episode. See ya next week 👋 !

PS: It took me 3 hours to write, edit, and design this newsletter. If you liked today’s post, you can help me grow by forwarding it to one person with a quick “You’ll love this newsletter. Totally worth signing up.” They can subscribe below 👇️

✅ Find all resources here.

✨ Special thank you to Gigi Marquez who suggested I start this newsletter 🙏